Difference Between Proforma Invoice and Quotation Explained

- 20 Nov 25

- 7 mins

Difference Between Proforma Invoice and Quotation Explained

Key Takeaways

- The key difference between proforma invoice and quotation is that a quotation gives an estimated price, while a proforma invoice confirms agreed pricing and terms.

- A quotation is shared at the proposal stage, whereas a proforma invoice is issued once the buyer accepts the quote, highlighting a major difference between proforma invoice and quotation.

- Exporters frequently use proforma invoices, while small businesses mostly rely on quotations—showing a practical difference between proforma invoice and quotation in usage.

- The detail level is a major difference between proforma invoice and quotation, with proforma invoices containing comprehensive cost breakdowns.

- Neither document is legally binding, but understanding the difference between proforma invoice and quotation prevents confusion in transactions.

Both proforma invoice and quotation (also known as quote) may look similar, but they serve two different purposes. A quote provides a quick estimation of costs for products and services before finalising a deal. A proforma invoice entails detailed information after the buyer agrees.

For instance, a printing company might provide a quote of ₹5,000 for printing brochures. Once agreed on the quotation, they provide a proforma invoice including taxes, final price and conditions.

Usually, small businesses use quotes, whereas exporters choose proforma invoices. Knowing the differences between proforma invoice and quotation prevents confusion.

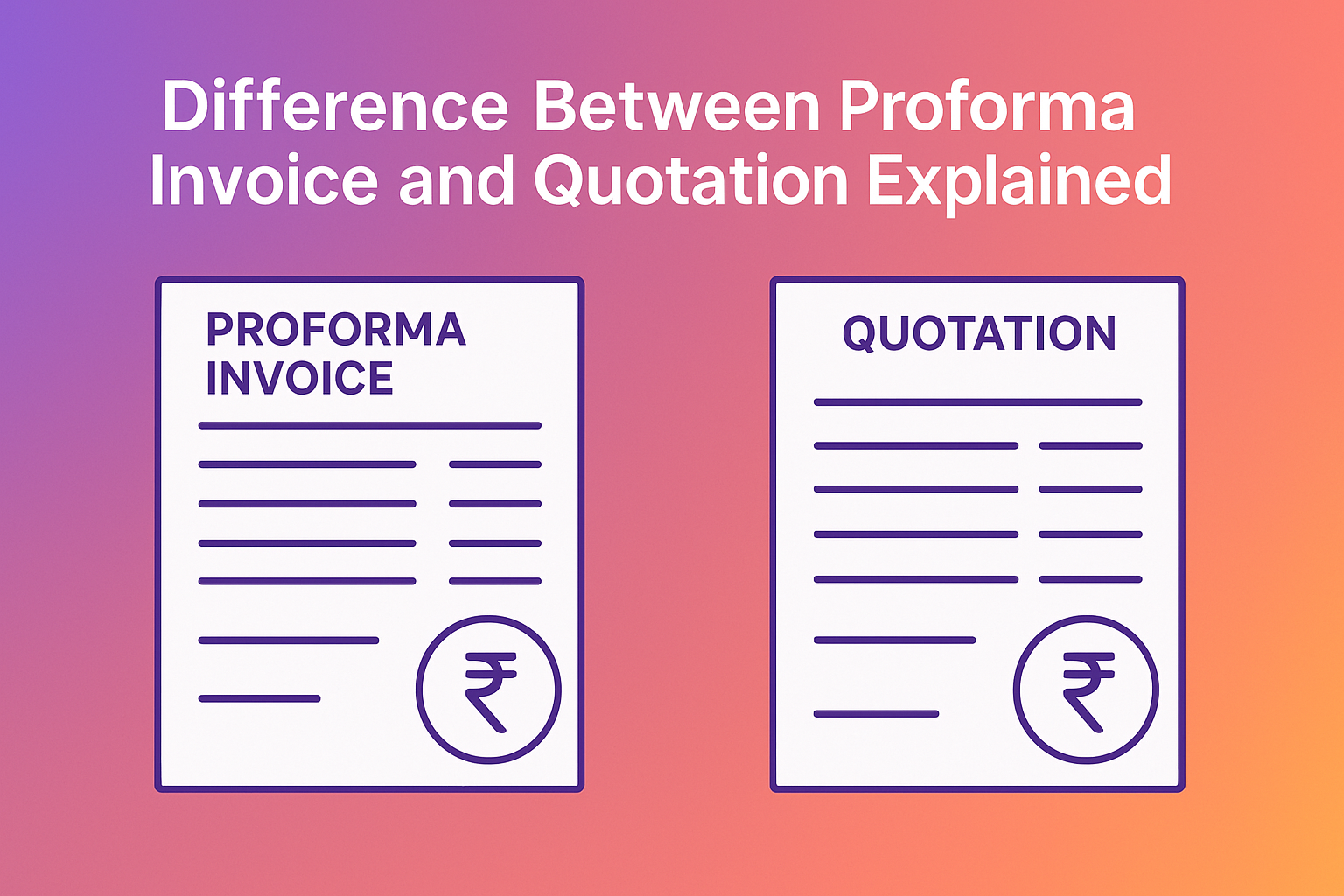

What Are the Key Differences Between Proforma Invoice and Quotation?

The table below highlights the key differences between proforma invoice and quotation:

| Parameters | Proforma Invoice | Quotation |

| Purpose | To declare the intent to sell under the following specific terms and conditions | For the estimation of the price of goods and services |

| Detail Level | Usually comprehensive, including shipping, costs and taxes | Usually brief, often focusing on price and basic terms |

| Timing | Takes place before the delivery stage, once agreed upon the details mentioned | Takes place at the proposal stage |

| Nature of Binding | Semi-formal with commitment to selling | Not binding; usually open for negotiation |

| Use in International Trade | Used commonly for duties, customs, and processing imports | Used rarely during cross-border transactions |

Now that we have identified the key differences between proforma invoice and quotation, let's dive deeper into the two concepts.

What Is a Proforma Invoice?

A proforma invoice is a draft version of an invoice shared with the customer before the final invoice. It also reflects a comprehensive breakdown of calculated costs after customers agree to purchase any product or service. This also enables buyers to get a clear idea of total costs in advance, particularly in international trade.

For instance, a supplier from India might send out a proforma invoice to any U.S. buyer for 200 phone cases worth ₹20,000 with shipping. This might be a genuine agreement, but it cannot be practised for actual payment. A proforma invoice is commonly used in exports and when dealing with large quantities of products.

What Are the Key Elements in a Proforma Invoice?

- Detailed Information of Buyer and Seller: Name, address of both buyer and seller, along with their contact information

- Date and Invoice Number: Date of issuing invoice, unique identifier for tracking invoice

- Estimated Costs: Taxes, subtotal amount, cost breakdown, delivery and inclusion of total anticipated amount

- Detailed Description of Goods and Services: List of goods and services purchased, quantity purchased, unit costs

- Terms of Payment: Instructions on how to make payment, when to pay and any applicable discounts

- Validity Period: Period during which the quoted price remains valid

- Currency: Transaction currency is crucial to consider for carrying out cross-border transactions

- Terms and Conditions: Additional terms and conditions related to the transaction that include details of warranty and delivery timeline

- Proforma Invoice Label: A mark of "Proforma Invoice" instead "Not a Tax Invoice" to distinguish it from a final sales invoice

💡Use the PICE App's invoice generator for your GST-registered business.

What Is a Quote?

A quote is a formal document a seller provides to any potential customer. It offers an approximate cost estimation for any particular goods and services before a sale happens. Providing quotes beforehand enables customers to analyse their budget, inclusions, deadline and terms and conditions.

For instance, a website designer might provide a quote of ₹21,000 for building a business site, with validity of 15 days. Sending clear quotes also prevents disputes. A quote might not create a binding contract, but it allows customers to show interest and proceed with the project following set conditions.

Why Do Businesses Issue Quotes?

The majority of businesses issue quotes to provide customers a clear idea about costs before beginning a job or starting to sell a product. A quote prevents confusion about timeline, price and services.

For instance, before starting to repair the house, a customer obtains quotes from the builder to get an idea of the budget. Reports also reveal that 65% of small businesses have agreed to provide clear quotes before starting a project to achieve profits and win a larger client base.

Quotes also safeguard both sides and prevent any disagreement later on. In specific industries such as printing, construction and IT services, setting quotes is a normal practice. It also makes the business appear professional and trustworthy, raising the chances of closing a deal conveniently.

What Are the Key Elements of a Quote?

- Price: This is the approximate cost of the products and services requested. It includes total cost, unit prices, taxes and applicable discounts.

- Scope of Work: This reflects the key inclusions in any service or product offered. From this, customers also get to know the inclusions and exclusions, to prevent confusion later on.

- Validity Period: Quotes remain valid for a limited period only. This section highlights the period stating how long the prices, as mentioned in the quote, will remain the same.

- Terms and Conditions: This section includes the important rules relating to how long the payment can be completed, how long delivery of products will take time, return policies, cancellation and any warranty or guarantee.

Is a Proforma Invoice and Quotation Legally Binding?

Neither a quote nor a proforma invoice is a legally binding document.

Usually, a quote is an offer and not a contract. Only when the customer agrees to the offered quote and both parties decide to proceed does it become a legally binding agreement. On the other hand, a proforma invoice doesn't indicate any sale or the amount a buyer should pay. It is rather a commitment towards providing any specific goods and services from the listed terms, if the buyer accepts the price and decides to proceed.

In addition, a proforma invoice is generated before any official transaction. Custom authorities might use this invoice for assessing duties. Rather than this draft version of the invoice, the actual invoice matters.

Conclusion

With clarity on the differences between proforma invoice and quotation, communication between buyers and sellers becomes smoother. Both of these concepts might not be legally binding, but they demonstrate professionalism and structured planning.

A quote is usually shared to attract the interest of customers and provide an idea of the budget. Whereas, a proforma invoice signals confirmation of the buyer's intent and highlights the final pricing. Thus, presenting the right document is crucial to maintain a clear transaction process.

By

By